Top Trend Reversal Indicators for Day Trading

Dec 17, 2023 By Triston Martin

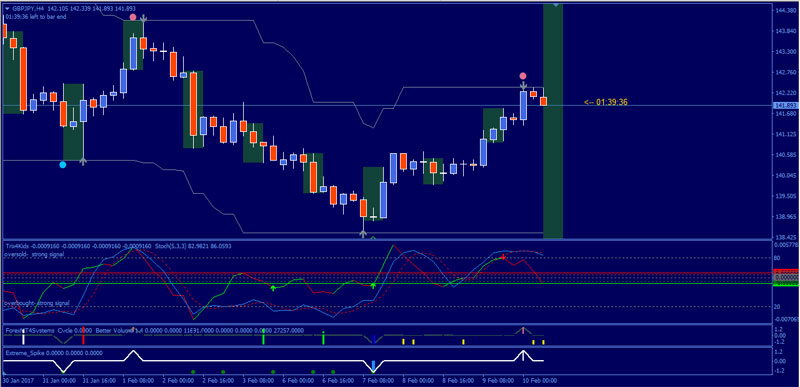

Several indicators may be used to detect and follow changing trends. Oscillators like the relative strength index (RSI) and the stochastic indicator are further examples of technical analysis tools.

When the moving average's slope changes, it may signal a shift in the trend. Using two moving averages with different time frames can also help identify trend changes; for example, a "golden cross" occurs when the shorter time frame rolling average rises above, the longer time frame moving average. A dead cross occurs when the shorter-term moving average exceeds the longer-term average.

Breakout techniques are used by the Donchian or Keltner Channels and Bollinger Bands to signify a change in trend. A breakthrough above the track signals a nascent uptrend, while a breakout below the channel signals a future decline. Both the MACD and the oscillators have overbought/oversold and divergence signals that may indicate a reversal in trend.

Which trend reversal indicator is the best?

Price action traders may choose to draw an arrow pointing toward the trend using a trendline. It may be used as a dynamic support (uptrend) and resistance (downtrend) level, above or below which price action is likely to cause a reversal in the prevailing trend.

Trend reversal indicators can employ various tools, including moving averages, like moving average convergence & divergence (MACD), Donchian or Keltner channels, Bollinger Bands, and oscillators such as the relative strength index (RSI) and stochastic, to identify a trend reversal.

Choosing the ideal indication for trend reversals is challenging since each indicator has advantages and disadvantages. Several applications of the moving average demonstrate when a trend has changed direction. For instance, the advice of a movement may be determined by observing the slope, and a change in the hill could indicate a reversal in the trend. Nevertheless, a big enough time setting, such as a 200-day moving average, causes this to lag the price significantly. A crossing between two moving averages may also be used to identify trend changes: a crossover above the shorter-term average (golden cross) or below it (dead cross) signals the beginning of an uptrend or a downtrend, respectively. Unfortunately, there may be a large number of spurious results.

While oscillators' overbought/oversold signal and divergence signal might alert traders to a possible trend reversal in the early going, these signals are often accompanied by numerous false ones, rendering them worthless for predicting actual trend reversals. They work best for identifying when a trend's retreat has concluded and reversed into a trend-continuing impulsive swing rather than the other way around.

The moving average is the basis for the other indicators we've discussed. The Moving Average Convergence Divergence (MACD) is an enhanced crossover indicator. Since most moving average hands have a natural lag, they are commonly linked to it. Here are best indicators for trend reversal for day trading.

Fibonacci Retracement Levels

Where this happens is where you'll find support (a price level an asset doesn't go below for a long time) or resistance (a price level an asset's price tries to move up against, where it encounters growing numbers of sellers eager to sell at that price). You may use it to plan your entry and exit prices and your goal and stop-loss levels.

RSI

Relative Strength Index, or RSI for short (RSI) is indicator for trend reversal in the world of day trading, and this technical indicator is a must-have. It's an oscillator that indicates which currencies are often bought and sold. The Relative Strength Index (RSI) is a momentum oscillator that reads from zero to one hundred based on the ratio of favorable to adverse price changes.

Overbought currency (one whose price has increased more than market expectations) is indicated by an RSI of 70 or higher. An oversold coin (one whose price has dropped below market expectations) is characterized by an RSI of 30 or lower.

Parabolic SAR

This shows where trends are heading and where they tend to reverse. This provides an additional benefit to traders by drawing attention to the direction in which an asset moves. The SAR trail approach determines when to enter and leave the market. The indicator is a sequence of dots above or below an asset's price.

Oscillator, Stochastic

This instrument's primary purpose is to identify overbought and oversold currency pairs. A closing price is compared to the entire range of prices. The fact that it tracks price momentum is a distinct advantage of this instrument. That's why market watchers use the price history as a barometer of momentum. It does an excellent job of highlighting pivot points.

Bollinger Bands

Another type of trend indicator is based on technical analysis. Its value is that they may be used to thoroughly examine all pricing information between two bands. You can use them to plan when to enter and quit a transaction. Overbought & oversold levels are calculated using them as well.