How to Start with Alternative Investments

Jan 29, 2024 By Triston Martin

Diversifying portfolios with alternative assets has the potential to increase total results. Such a possibility has fueled a rise in popularity. But not everyone should invest in alternative assets. By their very nature, these investments are more complicated than many common ones. Determining actual valuations can be challenging. Costs of purchases could be significant. While typically geared at institutional and professional investors, alternative funds have become accessible to individual investors. U.S. securities And Exchange (SEC) tend to be pretty illiquid. Because of its relative illiquidity and certain restrictions on particular asset classes, exiting such an investment can be more challenging. It would be best to research any potential alternative investments before making a purchase. Here is a little introduction to get things going.

Tips For Beginners How to Start With Alternative Investments

What Are Alternative Investments?

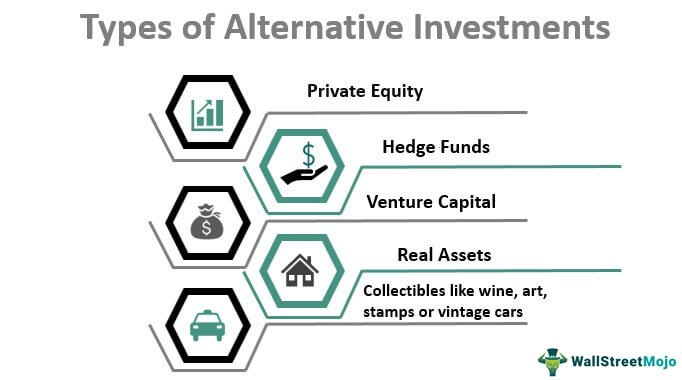

Investments that aren't in the traditional markets, including equities, fixed income, or cash, are sought after by investors who desire exposure to alternative assets. Black claims that both portfolio diversity and improved returns are objectives. According to him, alternative investments, like private equity or venture capital, have produced more remarkable returns than public equity markets. According to Joe McLean, portfolio manager of multifamily firm Intersect Capital, investing in market portfolios frequently necessitates purchasers locking in their funds for five, possibly 10 years. Investors might not receive any payouts during that time. Another problem is liquidity because investors can't simply access those assets should they want to because fund managers can't purchase or trade holdings like operators in traditional markets. According to Black, many other portfolio classes are not connected with stocks but are predicted to perform best during periods of flat or declining market returns. Here are a few specific categories of alternative investments:

- Personal debt

- Hedging funds

- Commodities

- Personal investment

- The property

- venture funding

Learning about Alternative Investments

Due to their complexity, regulation restriction, and risk level, most different investment assets are owned by accredited, slightly elevated individuals or investment institutions. Compared to unit trusts and exchange-traded funds, numerous alternative investments possess high minimum investment requirements and cost structures (ETFs). Additionally, these investments have fewer opportunities to promote to potential investors and provide verifiable performance statistics. Although alternative asset minimums, including initial investment fees, can be high, the low turnover of these investments usually results in lower transaction costs than those of more traditional asset classes.

Regulation of Alternative Investments

Due to the lack of rules, alternative investments are frequently subject to less clear legal structures than traditional investments, even when they do not include rare goods like coins or works of art. They are covered by the Dodd-Frank Big Finance Reform and Consumer Protection, and the United States can audit their operations. Commission for Securities and Exchange (SEC). They typically aren't required to register with both the SEC, though. As a result, unlike mutual funds and ETFs, they are not supervised or controlled by the SEC.

Alternative Investment Strategy

The correlation between alternative investments and those in traditional asset classes is often minimal. They frequently oppose the bond and stock markets because of their minimal correlation. They are an excellent instrument for portfolio diversification because of this attribute. Gold, oil, and real estate are all examples of complex assets that provide a solid hedge against inflation, which erodes the buying power of paper currency. Due to this, many big institutional investors, including pension and private endowments, frequently commit a modest amount of existing market portfolio only about 10%—to alternative investments like hedge funds.

Conclusion

Alternative investments might occasionally have a negative tax impact. Consider the case where you have a SEP-IRA or other self-directed retirement plan. You decide to use your SEP-IRA to purchase a maestro limited partnership (MLP) that owns an oil pipeline. While typically geared at institutional as well as professional investors, financial assets have become accessible to individual investors through alternative funds. U.S. securities And Exchange (SEC) and tend to be fairly illiquid. You might put your SEP-IRA in a position where it must file its own taxes and pay taxes. However, it relies on a variety of criteria. Another example: You are considering investing in the private sector. That might significantly increase the system's complexity, which may or may not be worthwhile. Although the partnership is set up for pass-through taxation, it lacks a statutory tax distribution condition.